Despite several setbacks, Non-fungible tokens (NFTs) driven by the advancements in smart contract technology, is still considered one of the most promising fields for the future of digital assets and transactions. NFTs continue to be a new and exciting application of blockchain technology.

In this article, we will take a closer look at the NFT hype from a current perspective, examining what NFTs are, how they are created, and where their potential use cases lie. Our goal is to provide a balanced and objective understanding of NFTs for readers with varying levels of knowledge, delving into technical aspects while also striving to present the information in a clear and easy-to-understand manner.

The picture has been created by DALL-E 2, having input "The First 5000 Days, many mosaics in one picture", inspired by an NFT called "Everydays: the First 5000 Days" which has been sold for 69.3M USD on Mar. 11, 2021.

Blockchain, Tokens and NFTs

To fully comprehend the concept of NFTs, it is essential to have a basic understanding of the underlying technology, blockchain, coins, and tokens. A blockchain is a decentralized ledger, similar to an accounting ledger, that is stored on multiple servers, ensuring that transactions are immutable and cannot be altered or deleted by a single owner. Smart contracts, which are automatically executed contracts that can transfer coins and tokens, are also crucial in the functioning of NFTs. These smart contracts are recorded on the blockchain and can be utilized for decentralized apps (dApps) that vary in level of centralization. Tokens, which are created by developers and support dApp functionality, are distinct from coins and their creation, distribution, and monetary management is frequently managed by public smart contracts. When evaluating the value and functionality of a token, it is important to consider the trustworthiness of the token creators and the transparency of the underlying programs.

An NFT as unique token serves as proof of ownership and authenticity of an underlying unique or limited digital asset. NFTs are a new class of digital assets that offer a secure and decentralized method of verifying ownership and authenticity of digital items. Unlike traditional digital assets, NFTs are unique and cannot be replaced by another seemingly identical item. The use of blockchain technology allows for a transparent record of all transactions made on it, making NFTs a dependable and unchangeable way to represent ownership of digital art, collectibles, and other types of assets. Furthermore, the use of blockchain technology ensures that NFTs are clearly attributed to an individual, even if copies of the digital item exist. As NFT technology continues to evolve, the potential uses for this revolutionary concept are becoming increasingly diverse, such as being a digital certificate of ownership for digital or physical items recorded on the blockchain. The popularity of NFTs is on the rise, and it is expected that the technology will continue to shape the digital landscape in various ways.

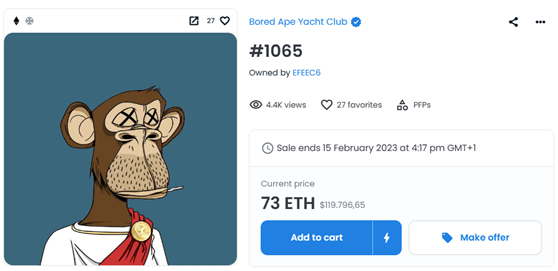

Picture: NFT Example - „Bored Ape“ from Yacht Club Series, offered on OpenSea.io for 73 ETH (~1,600 USD) in Jan. 2023

Use Cases

There are a plethora of potential use cases for NFTs. Some of the most notable and widely recognized applications include:

- Digital Art: NFTs are most commonly associated with digital art, and for good reason. NFTs allow for the creation of unique, one-of-a-kind digital artworks that can be bought, sold, and owned just like physical art. The use of smart contracts and blockchain technology allow for the verification of the authenticity of the artwork and the tracking of its ownership history. Prominent examples of artwork NFTs include Beeple and Bored Ape Yacht Club.

- Collectibles: NFTs can also be used to create unique, digital collectibles that can be used in video games, programs, and virtual environments. These collectibles can include anything from digital trading cards to in-game clothing or equipment for avatars. Players can use NFTs to prove their ownership of these collectibles and even monetize them on in-game or public marketplaces. Examples of gaming NFTs include Axie Infinity and CrytpoKitties.

- Digital Twins: Digital Twins are digital representations of physical objects. NFTs can be used to mint digital twins and assign a unique, verifiable owner to them, as well as controlling access to them. This can be useful in various industries like real estate, architecture and engineering.

- Virtual Real Estate: Another use case for NFTs is the creation of virtual real estate. This can include virtual land in online gaming environments, virtual spaces in virtual reality applications, and even virtual office space in online collaboration platforms. Owners of virtual real estate can use NFTs to prove their ownership and monetize their property.

- Identity and Access Control: NFTs can be used to create digital identities and control access to digital spaces and resources. This can include anything from access to private social networks to access to premium content and services.

- Supply Chain Management: Another key use case for NFTs is in supply chain management, where NFTs can be used to track the movement of goods, verify the authenticity of products, and even manage payments and other financial transactions. This can be used in various industries like agriculture, manufacturing, logistics and e-commerce.

These are just a few of the many potential use cases for NFTs, and as the technology continues to evolve, we can expect to see even more creative and innovative applications in the future.

NFT Market Figures

The NFT market saw a significant increase in popularity in 2021, particularly during the summer, driven by mainstream attention and high-selling prices for digital art. However, sales volume has since decreased. Despite this, industry experts are optimistic about the market's future growth, with predictions of reaching $3.5 billion in revenue by 2023 and $8 billion by 2027. This growth is expected to be driven by an increase in the number of users and the average revenue per user, projected to be $70 in 2023.

The NFT market is still relatively niche, with an estimated 0.7% of the total population projected to use NFTs in 2023, it is expected to become more mainstream in the coming years. Overall, the NFT market is a rapidly growing and exciting space with significant potential for growth in the near future.

NFT Technology

To understand the technology behind NFTs, it is first important to note that the NFT token itself is not the actual asset, but rather a reference to the underlying file, known as a "hashed file". It serves as a proof of ownership and allows for the transparent and permanent tracking of ownership and transactions on the blockchain. The process of creating and issuing a new NFT on a blockchain, known as "minting" requires the use of smart contracts and also the payment of a small fee called “gas fee”. The more custom and functional an NFT is, the more coding knowledge is required to implement it in smart contracts.

Picture: Example on minted NFT data, screenshot from OpenSea.io

The most popular blockchain for NFTs is currently Ethereum, which accounts for around 96% of the total trading volume of NFTs. This is due to its widespread use and well-developed ecosystem. To mint an NFT, one can either have programming skills and knowledge of blockchain-related programming languages or use readily available tools to bypass technical processes.

NFTs and fungible tokens differ technically in the minting process and the underlying smart contract standard they use. On Ethereum, for example, ERC-20 contracts are the commonly used standard for fungible tokens, while NFTs use ERC-721 or ERC-1155 contracts. These standards provide the necessary functionality for minting and trading unique digital assets.

NFT Formats

Typically, hashed objects are stored in one of the following forms:

- URLs: Hashed URLs refer to a website where the corresponding object is located. However, since most websites are hosted on centralized servers, these objects can be manipulated by the server host or website owner.

- InterPlanetary File Systems (IPFS): IPFS can be described as decentralized servers, making the network less dependent on centralized servers and big tech companies.

- On-Chain Storage: The hashed asset of an NFT can also be stored directly on the blockchain, which is tamper-proof and cannot be changed later.

- Off-Chain Storage: Another method for storing NFTs is off-chain storage, which refers to storing the underlying asset outside of the blockchain, but it's less secure than on-chain storage.

Not all NFTs are created equal, even if they are on the same blockchain. It's important to pay close attention to how the NFT is stored and the availability and access to the hashed objects, as this raises questions about actual ownership. This is particularly relevant in the context of so-called "metaverses," virtual worlds where the management, hosting, and access to assets should be carefully considered. This can be compared to buying digital games on Steam or movies on Amazon Prime - if the game or movie is taken offline, the user no longer has access to their purchased product. While NFTs may seem to solve this problem on the surface, it's not always the case.

Blockchains for NFT

Not all blockchain networks support NFTs. Ethereum is currently the most popular blockchain for NFTs, accounting for around 96% of the total trading volume. However, there are a growing number of blockchains that support NFTs and it's important to research which one best suits the specific use case. In addition to Ethereum, there is a continuously growing number of blockchains that support NFTs.

- Ethereum: the second largest blockchain overall with an established ecosystem, high transparency, liquidity, and a relatively high number of use cases and protocols, but also has high gas fees and a slow transaction speed.

- Solana: a blockchain that aims to be a "better" version of Ethereum with a high transaction speed and low gas fees, but is less reliable and established than Ethereum.

- ImmutableX: an Ethereum layer 2 solution that aims to make NFT trading more scalable, but also has reports of failed transactions and inconsistent transaction times.

- Cardano: a blockchain with higher scalability than Ethereum and a growing ecosystem with a strong research focus, but also has slow implementation of upgrades and a small ecosystem compared to Ethereum and Solana.

- Polygon (formerly Matic): an Ethereum layer 2 solution that aims to reduce gas fees for minting NFTs, but also has potential issues and security vulnerabilities, incurs high transaction costs and gas fees when buying or selling NFTs.

- Flow: a blockchain focused on scalability for transactions and gaming and NFTs, with high transaction speeds and security, but is relatively new and potentially unreliable.

- Binance Smart Chain: a blockchain that aims to be fast, cheap and low-energy, but lacks security and decentralization compared to Ethereum.

- Algorand: a blockchain that aims to provide fast and secure transactions with low fees, but is relatively new and lacks security and decentralization compared to Ethereum.

Choosing the “right” Blockchain depends on the specific case. Also, even if a blockchain is technically superior, it may not be the best choice due to lock-in effects and limitations in transferring NFTs. For certain business-specific use cases, private blockchains can be considered, but they are only recommended for larger companies and integrated processes as the costs can outweigh the benefits.

How to buy NFTs

To acquire NFTs, one must have a crypto wallet and enough native cryptocurrency of the blockchain the NFT is based on. It is important to ensure compatibility with the wallet, otherwise there is a risk of losing the NFT. There are multiple ways to purchase NFTs, which are as follows:

- Marketplaces: NFT marketplaces such as OpenSea or SolSea are the most accessible and popular way to purchase NFTs. Minted NFTs are either offered for fixed prices or in auctions by owners, or users can make offers that the owners can accept or decline. OpenSea.io is the largest and most well-known marketplace, but it's important to note that not all NFTs on different blockchains can be traded on all marketplaces.

- Public Mintings: Public mintings are the standard way to mint NFTs and make them available for purchase. This can be done through various platforms and the process is relatively simple.

- Over-the-Counter (OTC): OTC trading is a way to buy and sell NFTs directly with other individuals or groups, without using a marketplace. This can be done through various platforms, such as Telegram groups or Discord channels.

- Private Sales: Some NFTs are sold through private sales, which means they are only available for purchase by a select group of individuals or through a private auction.

These are the standard ways to acquire NFTs. Further types, such as INOs (Initial NFT Offerings) which use crowdfunding before minting, are not discussed in this article as they are relatively new, not widely used, and can vary greatly in detail.

Picture: "The Merge", the highest selling NFT to date at $91.8M USD on Dec. 2, 2021.

How to identify NFT projects and understanding potential threats

There are several ways to invest in NFTs, and it's important to consider why one wants to buy them and what types of NFTs to buy. Factors such as speculative investment, supporting artists by buying their artwork, or using NFTs in the context of a blockchain game as digital possessions should all be considered. NFT projects come in many forms, such as single images, elaborate roadmaps to build a franchise around NFTs, or metaverses where, as written earlier, NFTs can represent digital goods in virtual environments or be used to earn digital money.

Also, there are “white lists” which refer to a catalogue of pre-approved individuals or entities that are granted access to participate in an NFT offering and minting, typically through a registration process, before the NFT will go into a public minting or be sold to the public. This is often used as a way to control the demand and distribution of NFTs, as well as to prevent fraud.

When planning to buy NFTs, in order to reduce the risk of falling victim to a “rugpull” (=refers to the sudden and unexpected withdrawal of funds by the creator of a cryptocurrency project, leaving investors with worthless tokens), the following are some of the threats to be aware of:

- Doxed Creators: Doxing is the illegal practice of accessing and publishing the identity of an internet user. In the crypto space, doxted creators are considered positive because they voluntarily reveal their identity and can be verified. They are valuable in the anonymous crypto space as they can be held accountable for fraudulent activities in the real world.

- Known/renowned Creators: Both doxted and non-doxted creators who are already known and trustworthy in the crypto space are preferable to unknown or new faces. They are authentic and have experience in creating and managing crypto projects. However, projects from these creators may be highly sought after and difficult to mint, leading to high minting fees and prices on marketplaces.

- Storage method of the NFT: As we explained above, the storage method of the NFT should be considered, as some projects may use centralized storage, which is not as secure as decentralized storage.

- Roadmap and project details: It is important to read the project's whitepaper, website, and social media channels to understand the project's goals, vision, and development plans.

How to create your own NFT

Creating Non-Fungible Tokens (NFTs) is a process that involves several steps, starting with choosing the format for your NFT. The most popular formats include PNG for images, TIFF or Tagged Image File Format for printable items, MP4 for videos, and MP3 for audio files. The format you choose will determine how people can use your NFT, and it’s important to consider the limitations of the NFT marketplace you plan to use.

The next step is to decide on the content and availability of your NFT. Consider what the public might find valuable in a digital work of art, and think about making a limited number of NFTs to make them rare. The content, messaging, limited editions, historical significance, and intent all matter in digital art.

Once you have a clear idea of what your NFT will look like, it’s time to find a platform where you can create your NFT. Popular NFT marketplaces include OpenSea, Axie Marketplace, Rarible, and Mintable. Each of these platforms operates with different standards, such as which blockchain it supports, which file formats it supports, and the costs associated with minting your NFT.

To mint your NFT, you will need to open a crypto wallet and add cryptocurrency. This can be done by linking your wallet to a crypto exchange and purchasing the necessary currency. Some NFT marketplaces accept different cryptocurrencies, so be sure to check which one is required before you begin.

It’s important to keep in mind that creating an NFT is not a one-time process. You will need to continue to monitor and manage your NFT, including updating the content and making sure it remains accessible to buyers. With the right approach, creating and selling NFTs can be a rewarding experience for both creators and buyers.

Legal Issues

NFTs are currently not specifically regulated, but existing laws and regulations apply. Businesses must consider several commercial and legal issues when issuing, trading or exchanging NFTs. Clarity is crucial in defining the scope of the NFT and what rights are being sold, to avoid potential claims from purchasers. Due diligence is needed to understand what rights and obligations are being acquired, and the commercial rationale for issuing the NFT must be considered. Intellectual property rights must also be carefully controlled and licensed, and businesses must assess whether their NFT is a regulated investment or security.

Even though NFTs are not yet specifically regulated, they may trigger legal obligations if they exhibit characteristics of other regulated investment units.

Outlook

It is difficult to predict exactly what will happen with NFTs in the future, but there are a few potential developments and trends that experts believe may occur.

- Increased mainstream adoption: As the NFT market continues to grow and mature, it is expected that more people will become interested in NFTs and the possibilities they offer. This could lead to increased mainstream adoption of NFTs, with more businesses and individuals using them for a variety of purposes.

- Development of new use cases: As the technology and infrastructure for NFTs continue to improve, it is likely that new and innovative use cases for NFTs will be developed. These could include new types of digital collectibles, new ways of using NFTs in gaming and virtual worlds, and new ways of using NFTs to represent physical assets.

- Increased regulation: As the NFT market grows, it is likely that governments and regulatory bodies will take a closer look at the technology and consider how to regulate it. This could include new laws and regulations aimed at protecting consumers, preventing fraud, and ensuring the proper functioning of the market.

- Advancements in interoperability: As more and more different blockchain platforms and networks emerge, there will be an increasing need for interoperability solutions that allow NFTs to be easily transferred and traded across different platforms.

- Greater use in the art world: NFTs can potentially revolutionize the art world, giving artist and creators more control over their work, allowing them to monetize their creations in new ways and giving art collectors a new level of access to the market.

- Incorporation into existing systems: As the technology and understanding of NFTs continue to develop, it is likely that they will be incorporated into existing systems and platforms, such as e-commerce websites, social media, and gaming platforms.

It is important to keep in mind that the projections for the NFT market are uncertain and subject to change. The NFT market is still in its early stages and has already faced some challenges, making it difficult to predict its future trajectory. However, this also means that the NFT market has a lot of potential for growth and innovation. Additionally, as the market continues to evolve, it's possible that new developments and trends will emerge. Therefore, it's essential to approach any predictions or projections with caution, yet with an open mind and a positive outlook.

By Vincent Schwaner and Gernot Kapteina

Copyright: Barrons.com, The Merge, Bored Ape, Yacht Club Series, OpenSea, Beeple, Axie Infinity, CryptoKitties, Statista, InterPlanetary File Systems (IPFS), Ethereum, Solana, ImmutableX, Cardano, Polygon, Flow, Binance Smart Chain, Algorand, SolSea, Axie Marketplace, Rarible, Mintable, BuiltIn.com, OsborneClark.com, and any other trademarks, trade names, web site addresses, or logos mentioned are the property of their respective owners. This article was further optimized with AI technology from ChatGPT and DeepL.